To close the position, you can double click on line order

in a Terminal window (Trade). Or right click and select Close

Order. A dialog box will appear. Click the Close button.

The above steps are to close positions manually.

The position also automatically closed, if achieved some

condition:

1. you hit by a margin call. A description of the

a margin call can seen on the previous page.

2. Before you've set levels Take

Profit or Stop Loss. When the price has reached

This level, the position is automatically closed. So You

no need to bother waiting any price movement

The time.

The level of Take Profit (often called Exit or Target Price) is

the price is set a level to get the level

certain profit when prices touched on this point, a position will

closed automatically. For example, you buy a GBP/JPY at

148.12 level, and then you set the Exit Target in 149.12. When

the price touched the level 149.12 then your position will be closed

automatically.

Stop Loss level (often called level Cut Loss) is a

price levels set for reducing the potential loss

larger. When prices touched on this point, a position will

closed automatically. Example you buy a GBP/JPY at

148.12 level, because you are only able to loss 100 pips, then You

set a Stop Loss at 147.12. The position will be automatically closed,

when price touches the level 147.12.

Please note that how large Stop Loss level

or Take Profit can set strongly depends on the

policy broker. Misalnva there are brokers that limit that

Stop Loss and Take Profit should be a minimum of 10 pips from

market price.

You can set the level Take Proflt and Stop Loss on

When opening a position.

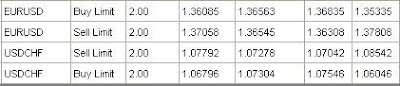

If successful, set the Stop Loss and Take Profit, then

the changes will be visible in a Terminal window (Trade).